January Market Update

All data is sourced from Altus Data Studio. Readers should verify information before making real estate decisions. All Information is gathered from the markets of Oakville, Burlington, Mississauga, Milton, and Brampton.

The commercial real estate market in Oakville, Burlington, Mississauga, Milton, and Brampton saw mixed performance in January 2025. While transaction volume increased by 15.38% month-over-month, it was down 18.18% year-over-year compared to January 2024. However, total sales volume surged 344.83% year-over-year, indicating that higher-value transactions are taking place despite fewer deals.

Key Highlights:

Oakville: Transaction volume dipped slightly, but total sales volume jumped 366.07% YoY, driven by high-value residential land deals.

Burlington: A modest 33.33% increase in transactions month-over-month, though sales volume declined by 51.08% YoY, signaling lower-value deals.

Mississauga: While transaction volume fell 38.24% YoY, total sales volume skyrocketed 382.94% YoY, thanks to a 1,576% increase in ICI land prices.

Milton: A sharp 100% YoY increase in transactions, with ICI land values soaring over 315% YoY, pointing to growing development interest.

Brampton: Sales volume surged 541.65% YoY, fueled by a 365.98% increase in ICI land prices and a 435.14% rise in residential land values.

Oakville

Oakville’s commercial real estate market remained active in January 2025, with total sales volume rising 366.07% YoY despite a 20% decline in transactions. Residential land sales were the primary driver, with a 997.23% increase in average selling price, reaching $33M. Office properties saw a slight 48.15% increase in average selling price, while retail properties saw declines. This suggests strong demand for land-based investments, while existing commercial assets may be facing weaker demand or fewer listings.

Oakville saw 6 transactions last month compared to 4 this month.

Burlington

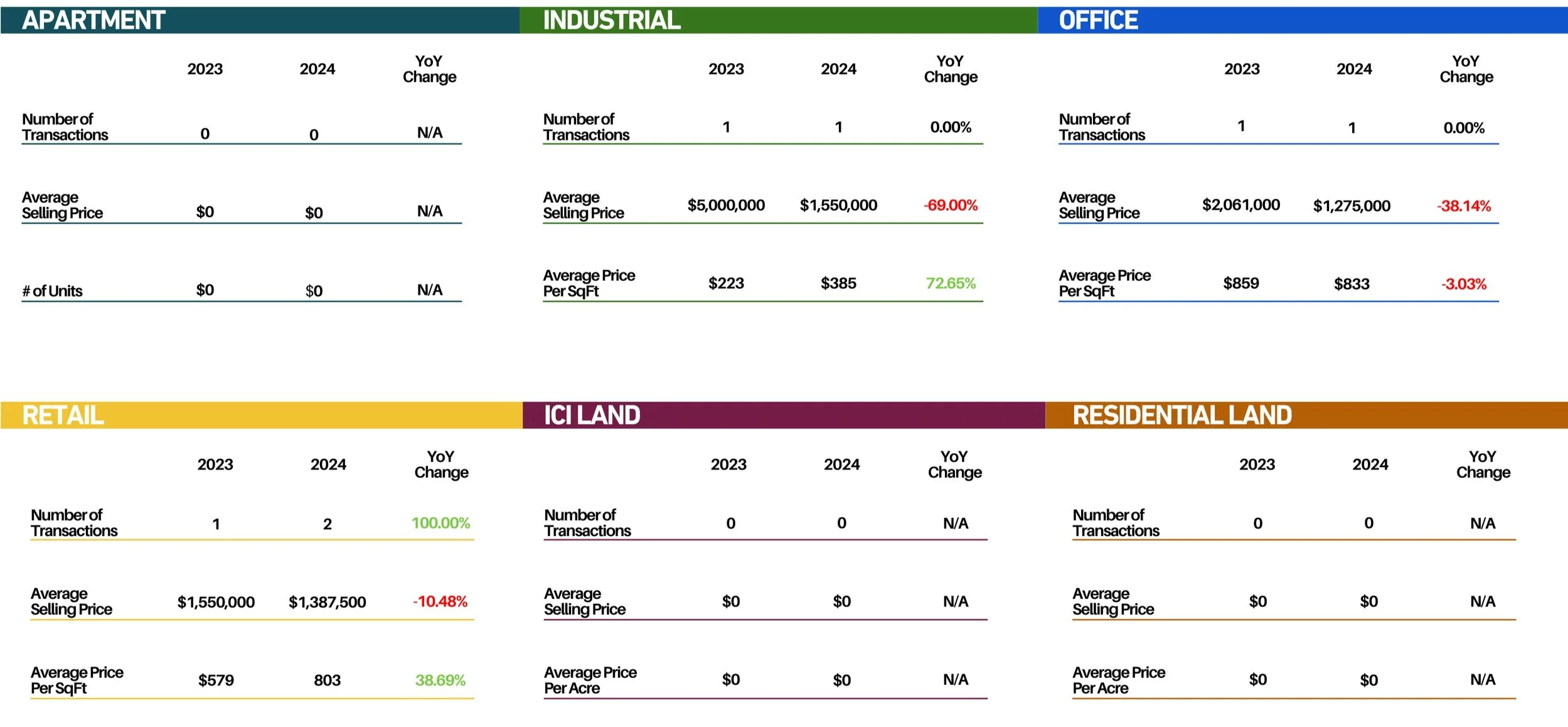

Burlington’s transaction volume increased 33.33% month-over-month, but total sales volume fell 51.08% YoY, indicating that smaller, lower-value deals dominated the market. Industrial properties maintained stable transaction volume, but the 69% drop in average selling price suggests a shift toward more affordable properties. Retail properties saw a 100% increase in transactions, but pricing remained relatively stable. The price per square foot for industrial properties jumped 72.65%, suggesting that while overall sales were smaller, demand remains strong for high-value industrial space.

Burlington saw 3 transactions last month compared to 4 this month.

Mississauga

Mississauga had a 38.24% YoY drop in transactions, yet total sales volume increased by 382.94% due to major land sales. ICI land transactions drove this trend, with the average selling price soaring 1,576% YoY to $67M. Industrial property sales declined by 36.36% YoY, but the average price per square foot rose by 13.16%, showing steady demand for quality spaces. Office space sales saw an 85.59% increase in average price, though only one transaction took place. Retail property values remained stable, but fewer deals occurred. Overall, investors seem to be focusing on high-value land acquisitions rather than existing commercial buildings.

Mississauga saw 13 transactions last month compared to 21 this month.

Milton

Milton’s commercial market showed significant growth, with transactions doubling YoY. ICI land sales stood out, increasing 200% YoY, and the average selling price surged 315.47% to nearly $9.65M. This suggests strong interest in future development opportunities in Milton. Industrial, office, and residential land remained largely inactive, signaling that while land investment is growing, other sectors may still be experiencing slow demand.

Milton saw 1 transactions last month compared to 4 this month.

Brampton

Brampton’s commercial real estate market had a 9.09% YoY increase in transactions and a 541.65% jump in total sales volume, making it one of the strongest-performing regions in January. ICI land saw a 365.98% increase in value, while residential land prices climbed 435.14% to nearly $19.8M. However, industrial and retail prices dropped, indicating shifting investor focus toward land-based development rather than existing commercial properties.

Brampton saw 16 transactions in December compared to 12 this January.