March Market Update

Disclaimer: All data is sourced from Altus Data Studio, which reports commercial real estate transactions valued at $1,000,000 or more. Information presented reflects activity in the markets of Oakville, Burlington, Mississauga, Milton, and Brampton. Readers are encouraged to verify all details independently before making any real estate decisions.

March 2025 saw a notable rebound in commercial real estate activity across Oakville, Burlington, Mississauga, Milton, and Brampton. Transactions increased 73.68% month-over-month, and total sales volume surged 382.42% compared to February. While the number of transactions was still down 26.67% year-over-year, the market showed signs of renewed confidence, especially in Brampton and Oakville.

Key Highlights:

Oakville: Strong rebound in industrial and office activity, with average prices climbing.

Burlington: Small but steady growth, with new activity in apartment and industrial sectors.

Mississauga: Balanced activity across multiple sectors with increased volume despite fewer deals than last year.

Milton: Fewer transactions overall, but residential land values more than doubled.

Brampton: Massive growth in sales volume driven by a high-value industrial deal, despite fewer transactions.

Oakville

Oakville had a productive March, with increased activity in industrial and office sectors. Industrial properties averaged over $14.4M, up 80% from last year, while office space saw a modest 3% gain in average price. Although retail transactions declined, price per square foot rose 32.2%, suggesting better-quality properties were traded. The city's overall sales volume rose 23% YoY, showing confidence returning to the market.

Oakville saw 7 transactions this March compared to 8 transactions last March.

Burlington

Burlington remained relatively quiet but showed signs of modest growth. A new apartment transaction was recorded, and industrial activity resumed after being dormant last year. The average industrial price came in at $4.7M, while the apartment deal closed at $1.87M. Retail held steady with one deal, although the average price fell. Total sales volume rose 17.6% YoY, and a broader mix of asset classes emerged.

Burlington saw 3 transactions this March compared to 2 transactions last March.

Mississauga

Mississauga had a solid March despite a 27.78% drop in transactions YoY. Industrial, office, and retail activity remained steady, with improved pricing in the retail sector. Office price per square foot nearly doubled, and industrial space averaged over $7.5M. An apartment deal and strong price-per-square-foot metrics suggest renewed interest in select high-value assets.

Mississauga saw 13 transactions this March compared to 18 transactions last March.

Milton

Milton experienced a quieter month with a 66.67% drop in transactions YoY, but the lone recorded deal—a residential land sale—closed for $5M, more than doubling last year’s average. Though other sectors like industrial and retail remained inactive, the high land value shows developers still see potential in the area.

Milton saw 1 transaction this March compared to 3 transactions last March.

Brampton

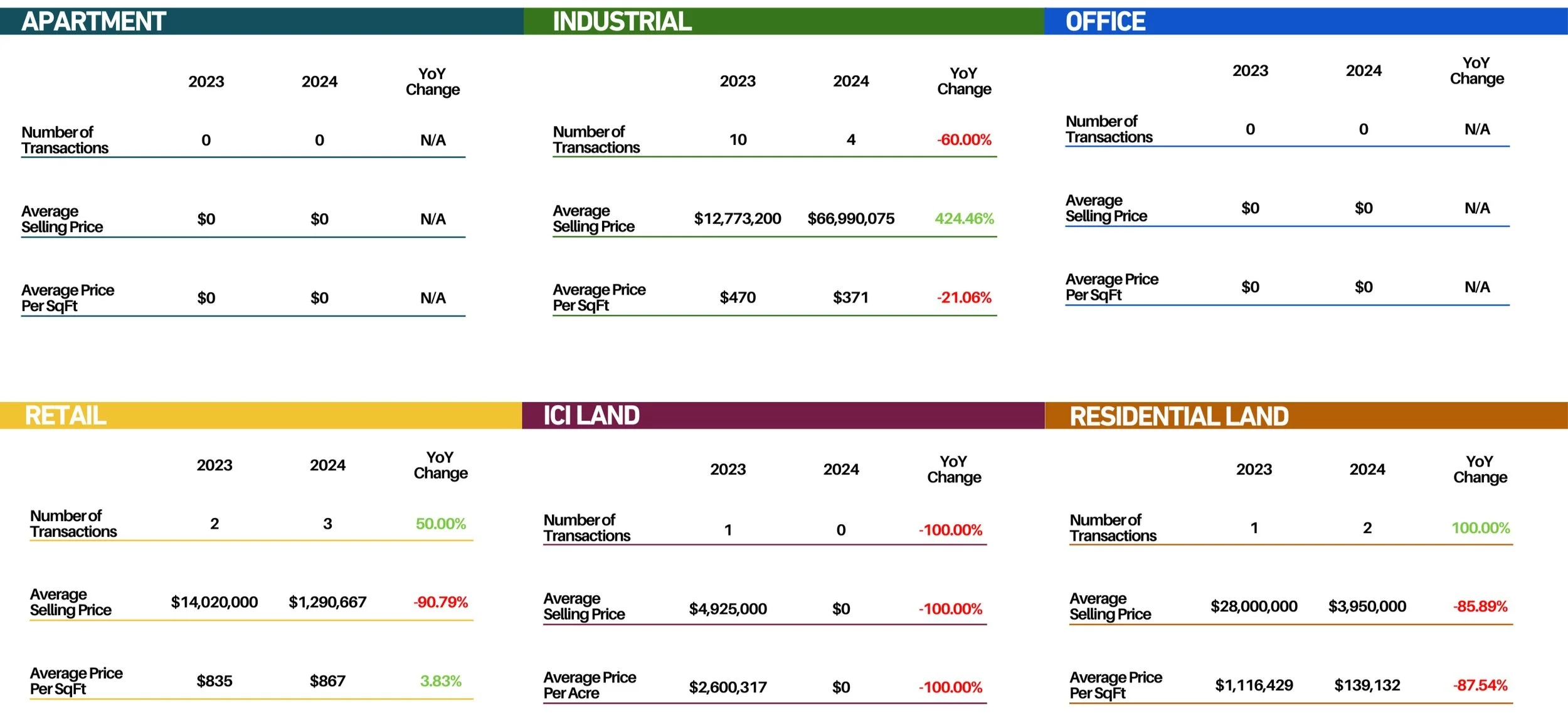

Brampton led all regions in total sales volume, rising nearly 21% YoY to over $72M. This was largely driven by a high-value industrial transaction, with an average price of nearly $67M across four deals. Retail activity also picked up, while residential and ICI land sales slowed. Despite fewer transactions, Brampton proved that a few large deals can dramatically shift market totals.

Brampton saw 9 transactions this March compared to 14 transactions last March.